How the Fuck Did We Let the American Dream Become a Floorplan?

From cul-de-sac captivity to global collapse: how privatized power rewrote the future.

I used to believe that if I played by the rules, that if I served my country, worked hard, and raised my kids under a flying flag, I'd win the game.

And for a while, I did.

My husband and I, both veterans who believed we bought our slice of the American Dream in a Southern California suburb… new construction, a metaphorical white picket fence, American-made truck paid off in the driveway. A flag on the porch we didn't question.

We thought we'd made it.

What we didn't realize was that our dream was someone else's asset. A floorplan on a spreadsheet. A return on investment for people who would never live on our street.

We didn't own that dream. We were leasing it—from Wall Street.

It took us years—and everything short of a breakdown—to admit it: The Dream wasn't working. We weren't building freedom. We were paying into a system designed to siphon our energy, our money, our future.

And so we left our high-stress careers and cookie-cutter existence for something more authentic. Not because we had to. Because we were suffocating in the lie that what we had was what we really wanted to feel whole.

We traded our cul-de-sac for a 100-year-old farmhouse in the mountains. Same value on paper. But the life? Unrecognizable. We buy from our local Ace Hardware now, not Amazon. We wake up to fog, not leaf blowers. There's no HOA. No cell service if the power is lost. Just dirt, and work, and something that feels dangerously close to peace.

But even here, we're not free. Because even here, we are still part of the system. Even here, we check the market. Even here, we wonder if we can live ethically and still secure our daughters' future.

The American Dream wasn't a house. It was a promise they leveraged to keep us invested in a game rigged against us from the start.

A Dream Built to Be Bought

It was never built to be lived in. It was built to be bought—and resold at a premium.

In 2024, BlackRock disclosed it owned over 10% of Lennar Corporation, one of the largest homebuilders in the country. They hold nearly 10% of D.R. Horton, and 11% of KB Home—the corporations that shaped the beige suburban sprawl most Americans associate with success. Not just control of homebuilding—control of middle-class aspiration itself.

That was our neighborhood. Marketed to families that looked just like mine—dual-income couples, kids in public schools, flags on porches. The perfect demographic: stable enough to qualify for loans, aspirational enough to stretch beyond our means, grateful enough not to question why everything we "owned" felt borrowed.

Homes that were built to be multi-generational living would be filled with the conflict of generational trauma all being listened to by your smart home devices to turn your pain into an advertisement on the latest wellness product. Add in soaring property insurance in climate-risk zones where rates have doubled or disappeared entirely, and the picture clarifies: our homes weren't shelter, they were financial instruments. Bets someone else was hedging on our emotional labor and relentless striving.

While we mowed lawns to avoid HOA fines and nodded to neighbors treading water beneath farmhouse sinks, BlackRock expanded silently—acquiring ports, farmland, water rights, infrastructure. Our mortgages were just the foothold.

Now, those of us who fought wars, raised families, built careers inside this narrative—we're left holding the bag. Or renting from someone who holds it. Or dreaming of a home that's already been securitized into someone's ETF.

It's not a moral failing. It's not about work ethic or bootstrapping.

It's design.

And if we don't name that design out loud, we'll keep blaming ourselves for not thriving in a system built for our extraction, not our prosperity.

2008 Was a Warning, But I Didn't Feel It

In 2008, the world cracked.

Banks failed. Families lost homes. The American middle class took a hit some families still haven't recovered from.

And I? I was sitting in lecture halls at a prestigious university on a military scholarship, studying engineering while my friends tried to scrape together student loans. While classmates juggled part-time jobs and worried about what came next, I had a guaranteed paycheck waiting for me. Government-backed higher education. A pathway to a home loan. Healthcare. Stability.

I didn't earn that security by being better or smarter. I just signed a contract to serve at 18, driven by a Post-9/11 recruitment poster with promises of purpose and direction. A deal that I took believing it would give my life meaning also cushioned me from an economic collapse I barely understood.

I wasn't thriving—but I was insulated.

While news anchors talked about subprime mortgages and credit default swaps, I was sweating through Mountain Warfare School. I was more focused on surviving training and the engagement ring I hoped was coming than on headlines about economic collapse. My now-husband was finally moving back to California after two years of long distance, and we were preparing to rent our first house together—a hundred-year-old Craftsman with a white picket fence that was at the top of our budget.

I didn’t understand what was happening to the housing market, or how Wall Street worked, or what the Fed even was. What I did understand was the look on my parents' faces when they sold off their retirement portfolio in a panic. I didn’t know what a premature stock liquidation was, but I would feel the damage it left behind years later when they needed a financial backstop and only had me. They were trying to protect something too—but the system wasn’t built to be navigated in fear.

But I remember the foreclosure signs—spreading like weeds through our low-income neighborhood. I started to hear it too, in the conversations with my civilian peers: the quiet panic, the plans that had evaporated overnight. And in those moments, I felt the weight of my privilege—earned not through wealth or status, but through the insulation my military service provided. It wasn’t comfort. It was distance. And it showed up in every conversation with someone whose vision of the future had collapsed while mine was still being subsidized.

Now, fifteen years later, it’s happening again.

What most Americans don't realize is that BlackRock was brought in by the U.S. government to help manage the financial fallout of the 2008 crisis. They didn't buy toxic assets outright—they managed portfolios from failing institutions like AIG, Bear Stearns, and the mortgage giants Fannie Mae and Freddie Mac. While families lost homes, BlackRock earned management fees and political access, expanding their influence across public and private sectors. The crisis wasn't just survived by the financial elite—it was leveraged into unprecedented power.

Back then, I was too focused on becoming an officer to question the system I'd enlisted into. Now, I live on a mountain, growing my own food, wondering if opting out is enough. If my daughters will face the same manufactured crises, packaged in different terminology but designed for the same extraction. When their crisis comes—and it will—they'll inherit a game where the winners of the last round have already rewritten the rules in their favor, consolidated their positions, and barricaded the exits.

We’ve been here before. And if we don’t name it now, our children won’t just inherit our mistakes—they’ll be trapped inside them.

Leaving the Dream, Finding the Land

We left all we had been sold behind.

We walked away from the suburban dreamscape—schools that were good on paper but struggled behind closed doors to keep their students safe, HOA newsletters about community events organized by people who would exclude diverse ideas, white-washed Memorial Day celebrations and Fourth of July parades that sanitized the violence and sacrifice they claimed to honor. We didn't leave in ruin. We left in defiance.

We downsized our square footage to bring our family closer together, investing in a life that would allow us the opportunity to take more breaths, have more space for our children to run, more silence to hear ourselves think about what used to be so loud. We didn't just leave a house—we left the rhythm of constant acquisition.

And the truth is, the top three asset managers in the world don't want you to make the move we did. They don't want you moving outside the system. They want you locked in, held hostage by the illusion of choice in rows of builder-grade houses. They want you addicted to new—the latest floorplan, the seasonal refresh, the dopamine drip of overnight delivery. They want you spending your paychecks, your mortgage interest, your retirement contributions, your impulse buys—on their balance sheets.

Because the more you buy, the more they own.

They own the companies that build your homes. They own the goods shipped to fill those homes. The farmland where our produce grows that we cook in our kitchens. The reservoirs that hold our water that pours from our taps. The ports our goods ship through. The highways we drive our Teslas on. The hospitals we rush to in emergencies. Even the schools we trust with our children's minds are increasingly steered by private capital and corporate agendas.

They own the retirement fund you sacrifice your presence for. And they control the algorithm whispering that you're never doing enough, having enough, being enough.

They don't want you shopping at the local hardware store. They don't want your money staying in your town, in your soil, in your neighbor's pocket.

They want frictionless living—because friction creates resistance. And resistance means you might wake up and notice the Dream is a cage with recessed lighting and smart appliances.

Meanwhile, They're Buying the Panama Canal

While we budget for groceries—while families negotiate layoff rumors and bank fees, Larry Fink is buying ports.

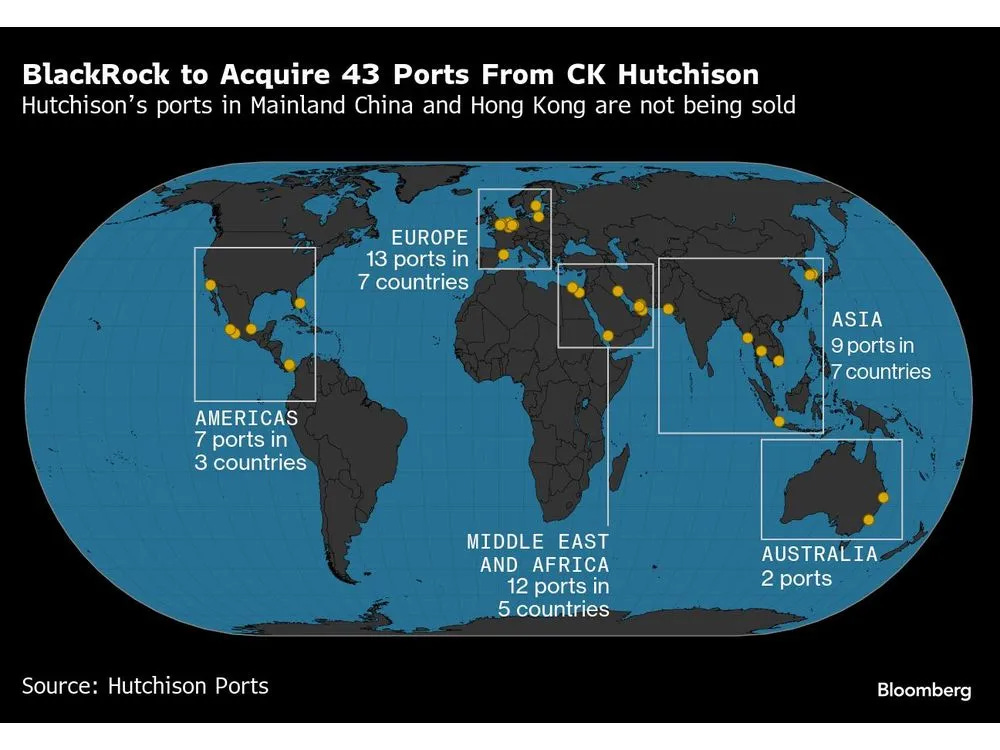

Forty-five of them. Across 23 countries. Including Balboa and Cristobal at the Panama Canal—one of the most geopolitically significant shipping corridors on Earth.

This is not metaphor. It's not an exaggeration. It's a $22.8 billion acquisition by BlackRock, facilitated by a Hong Kong-based conglomerate under pressure from U.S. political operatives. It gives an American investment firm operational leverage over one of the world's most critical supply chain arteries.

And it happened days after Donald Trump threatened to retake control of the canal, claiming that the U.S. was being "overcharged" and had made a mistake relinquishing ownership to Panama in 1999.

"We should have never given it up," he said. And now? Through private capital? He got it back.

BlackRock's CEO, Larry Fink, delivered the deal. And with that single move, he cemented a seat inside Trump's inner circle—alongside Elon Musk, JD Vance, and the National Security Advisor. All of them met behind closed doors at the White House in March.

Topic of discussion? The ports. The economy. The power.

This isn't economic policy. It's a military-grade financial maneuver.

Trump wants leverage over China. Fink wants private control over the movement of commerce. And together, they've weaponized infrastructure as soft power—replacing boots on the ground with contracts in the boardroom.

And back at home? We're told to be patient. To trust the market. To keep paying into our 401(k) portfolios while BlackRock reshuffles the global chessboard from behind a press release.

This is what modern empire looks like.

There are no tanks.

There are no parades.

Just acquisition strategies and geopolitical asset swaps.

And we voted for this.

Whether you pulled the lever for Trump or sat out in silent protest—this is the system we've been groomed to accept.

Because they don't need to govern when they own the lanes.

The same firm that owns 10% of the companies building your neighborhood is now co-opting international trade routes in the name of "national security" and "market opportunity." And while our neighbors argue over interest rates and inflation, BlackRock is standing at the intersection of money, tech, military strategy, and logistics, unbothered by either political party because people in power like Larry will play every side, every time.

They're not betting on your financial health. They're gambling with it. Then selling you the illusion that you still have a stake in the game.

The Cult of Collapse and the Catch-22 of Consciousness

There's a twisted brilliance to what's unfolding—one that becomes more obvious the further you step outside the noise. Our economy is tanking, and it's not by accident. It's by design. It's not collapse—it's MBA 101 on restructuring, and those at the top are all in.

My husband, half-jokingly but not really, called Trump Thanos. One snap, and half the government and the economy gets erased for being unsustainable—not to bring balance, but to bring control. To collapse the system and rewrite it with fewer players, bigger monopolies, and tighter chains.

The chaos, the market bloodbaths, the price hikes—those are the smokescreens. While Americans panic over their grocery bills and retirement accounts, the real war isn't televised. It's embedded in the fine print of global acquisitions, military posturing, and manufactured crises.

We're told we're in a trade war. That's true. But it's not just about China or Mexico or even Israel. It's about who controls the rules when everything resets.

While the global economy bleeds, ships keep sailing into conflict zones. China is entrenching itself in the South China Sea—militarizing islands, simulating attacks on Taiwan, sabotaging subsea cables, and expanding influence through infrastructure deals and espionage.

Their economy is unraveling. Youth unemployment is surging. The property market has collapsed. And yet—they keep building.

This isn't just about peaking powers. It's about two empires, both past their prime, vying for control in the endgame.

And that's the fucked-up part: they both know time is running out.

If Trump is Thanos, Xi Jinping is the sorcerer with the clock. Both willing to risk it all—because neither can afford to wait.

And here we are. Awake. Aware. And utterly powerless.

Because the deeper your awareness becomes, the more you recognize that every single lever of power—from your mortgage to your media to your groceries—is part of a system that thrives on your complicity.

We are the consumers funding the war. We are the workers propping up the lie. We are the retirement account holders hoping our stocks go up, even if it means someone else's land gets strip-mined, bombed, or privatized.

That's the catch-22 of consciousness. You wake up, and there's nowhere clean to stand.

So you do what you can. You leave the suburbs behind. You plant seeds in the dirt. You spend your money at Ace Hardware instead of Amazon. And you write. Because it's one of the last free things left.

How the Fuck Do We Reclaim the Dream?

Maybe it starts by asking the question out loud: What if the American Dream was never ours to begin with?

What if it was always a carrot—hung just high enough to keep us working, just far enough to keep us from questioning, and just fragile enough to make us grateful for the scraps given to us by the billionaires at the top—the BlackRocks, the Musks, the Finks?

Easy to blame them as the villains in the end game, but they only capitalized on the problems we were conditioned to demand solutions for: more convenience, more novelty, more distraction.

We didn't ask for safety. We asked for speed. We didn't ask for sovereignty. We asked for ease. And they delivered—in the form of one-day shipping, curated feeds, turnkey homes, and seamless subscriptions—comforts that now own us.

But beneath the craving for dopamine hits and drive-thru life, what we were really starving for was foundational safety. To know that the roof over your head won't be ripped away. That you can afford groceries without checking your credit card balance. That your child can go to school without absorbing the trauma of a broken world.

And as we watch the world tip into chaos, the scaffolding that once attempted to provide that safety to citizens—even if ineffectively—is being quietly dismantled. Social Security. VA benefits. Public education. Healthcare. The departments meant to protect us. Not because we can't afford them, but because we've given incentive to privatize them instead.

They've replaced the safety net with a subscription model. If they can convince you that public schools are broken, they'll sell you an app to homeschool your kids. If they can convince you that Medicare is failing, they'll sell you concierge care through a fintech startup. If they can convince you that veterans are a burden, they'll replace your benefits with a branded donation link and a patch that says thank you for your service.

Reclaiming the dream doesn't mean fixing the whole system. It means divesting from it—bit by bit, act by act. Living like your peace matters. Building like someone else's life depends on it—because it does.

The problem isn't suburbia itself, or wanting better for our children than we had. That desire—to create a future where our kids thrive—might be the most redemptive part of being human. The suburbs aren't inherently evil; they're just the most profitable manifestation of our deepest hopes, repackaged and sold back to us.

What matters is recognizing the echo chambers that form around us, questioning the grind that pulls us away from being present with our children, and understanding our place in the system that profits from our exhaustion. The problem isn't the dream—it's how it's been weaponized against us.

We each carry a power they don't want us to recognize: where we live, how we spend, what we teach our children, who we connect with. Every dollar is a vote. Every choice is a tiny rebellion—or a silent agreement.

What game are you playing? Whose dream are you funding? What small act of resistance might crack open something real in your own life?

Watching the stock market crash like déjà vu from a time when you knew less than you do now, ask yourself—how the fuck did we get here? And more importantly, what's your first step back out?

About the Author

I’m Alisa Sieber—a writer, veteran, and relentless question-asker, exposing the patterns of power, control, and resistance that shape our world. My work blends personal reckoning with systemic critique, challenging the narratives we’ve been told and demanding we ask harder questions.

Share How the Fuck Did We Get Here?

How the Fuck Did We Get Here? is a deep dive into the systems failing us, the leaders gaslighting us, and the patterns of control we can’t afford to ignore. If this article resonated with you, share it with someone who needs to see the bigger picture.

Subscribe to How the Fuck Did We Get Here?

A new How the Fuck Did We Get Here? is published every Monday at 9 AM PST. Subscribe to stay informed, stay questioning, and never look away.

Also Read: How the Fuck Did I Get Here?

If you’re interested in personal storytelling, breaking generational cycles, and reckoning with trauma, identity, and resilience, check out my other series, How the Fuck Did I Get Here?.

This series explores the deeply personal side of survival and transformation—where I ask not just how the world got here, but how I did.

A new HTFDIGH essay drops every Friday at 9 AM PST.

👉 Read How the Fuck Did I Get Here?

🔗 Connect with Me

📲 Instagram: @alisa.sieber

🌍 Bluesky: @alisasieber.bsky.social

💬 Leave a comment below—I’d love to hear your thoughts.

Sources & Further Reading

Lemire, Jonathan. “Trump Is Willing to Take the Pain.” The Atlantic, April 7, 2025.

A look inside Trump’s second-term tariff strategy and the calculated economic pain behind it.

Read here →Kelly, Laura. “5 Takeaways from Trump-Netanyahu Meeting in Oval Office.” The Hill, April 7, 2025.

Key insights from a high-stakes Oval Office meeting—covering Iran, tariffs, and control over Gaza.

Read here →Warfronts. The Peaking Power Trap: Why China Is Now More Dangerous Than Ever.

Deep dive into China’s economic unraveling, military ambitions, and the global implications of the “peaking power trap.”

Watch here →U.S. Department of Defense. Annual Report to Congress: Military and Security Developments Involving the PRC (2024).

Overview of China's expanding military capabilities and global reach.

Read here →BlackRock 13F SEC Filings (2024).

Public disclosures detailing institutional holdings in Lennar, D.R. Horton, KB Home, and other key infrastructure assets.

Search filings →Lowrey, Annie. “Here Are the Places Where the Recession Has Already Begun.” The Atlantic, 2025.

Reporting on the quiet economic bleed already impacting working families.

Read here →Tankersley, Jim. “Inside Trump’s Economic Circle: Musk, Navarro, and a Return to Chaos.” The New York Times, April 7, 2025.

Insight into internal tensions over tariffs and conflicting strategies among Trump’s top economic advisors.

Read here →Hanbury, Mary. “BlackRock Stock Bashed as Chinese Ire Against $22.8B Panama Deal Grows.” Business Insider, April 2025.

The geopolitical fallout and corporate backlash surrounding BlackRock’s port acquisition.

Read here →